GEW Briefing

The National Oil Corporation (NOC) of Libya has selected Oilinvest, a Libyan sovereign wealth fund subsidiary, to manage a significant new pipeline project in the Waha oil fields in the Sirte region. This decision is part of Libya’s ongoing efforts to develop its oil infrastructure and increase production capabilities. The pipeline project, which is estimated to cost around $2 billion, is a strategic investment for the country, which relies heavily on oil and gas for its national exports and revenues. Oilinvest’s selection over other competing firms from the United Arab Emirates and Egypt indicates a preference for a Libyan-managed project, potentially reflecting national interests or strategic economic policies.

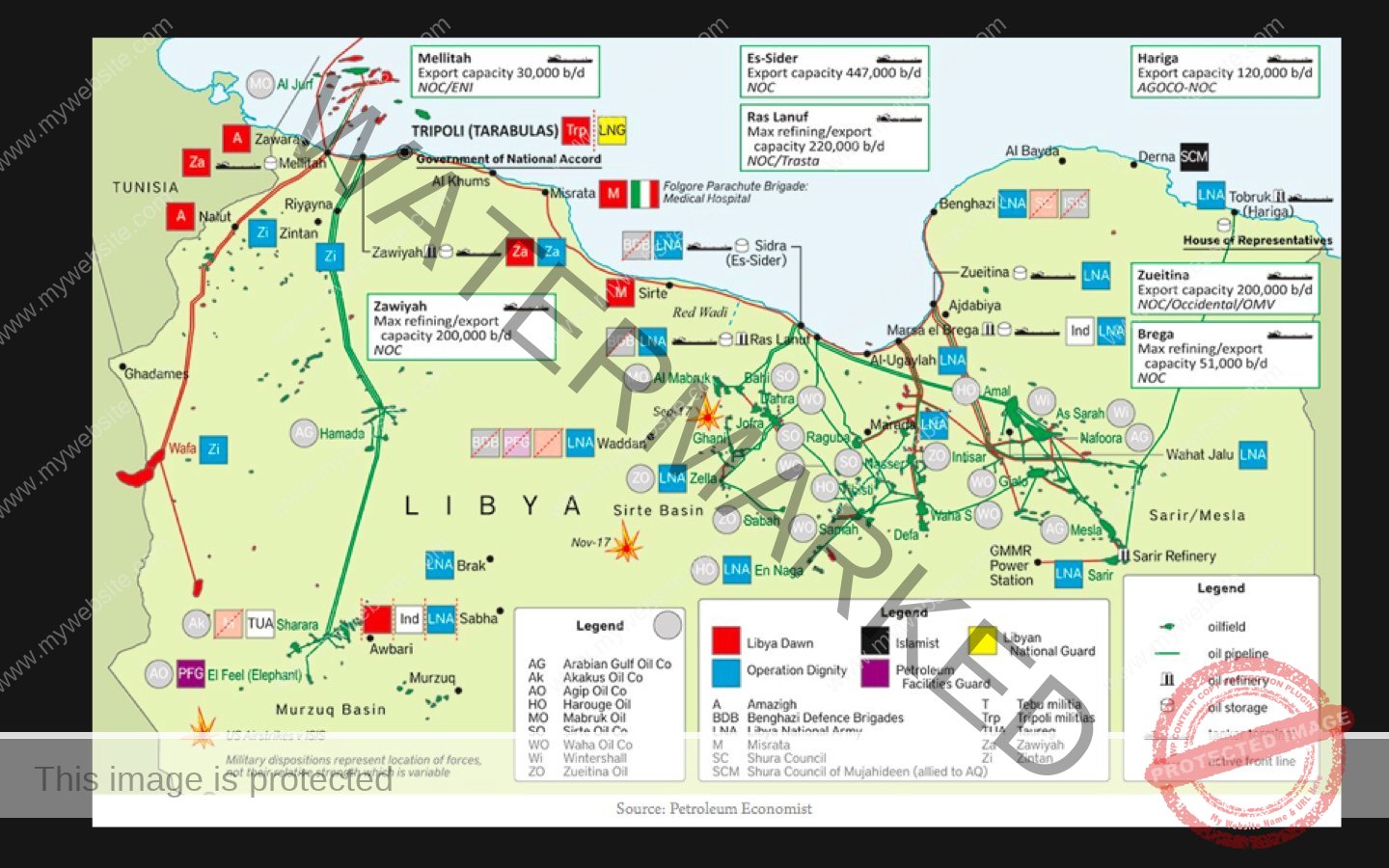

The Waha oil fields are a crucial asset within Libya’s oil sector, and the development of this mega-pipeline is expected to enhance the country’s ability to transport oil, thereby increasing export capacity and revenue. However, the broader context of Libya’s energy sector includes challenges such as political divisions, recurrent fuel shortages, and public pressure against removing subsidies, which could impact the implementation and success of such ambitious projects.

The Waha oil fields project refers to the development and expansion of oil production in the Waha Concession Fields, which are a series of conventional oil fields located onshore in Libya. These fields are operated by the Waha Oil Company, a Libyan National Oil Corporation (NOC) subsidiary. The Waha oil fields are a significant part of Libya’s oil sector, contributing approximately 19% of the country’s daily output.

The project includes various activities such as maintaining and restoring oil wells, developing new wells, and constructing associated infrastructure like pipelines. For instance, the Waha Oil Company recently announced the completion of maintenance work for 51 oil wells, which is expected to increase production by 14,650 barrels per day (bpd). Major projects within the Waha concession in the Sirte basin, such as Faregh II, NC-98, and North Gialo, aim to revive regional production.

The Waha fields have been producing oil for over 60 years, with the four main fields being Waha, Gialo, Dahra, and Defa. These fields are mature, and all wells produce oil. The Waha field is an important asset, with a production capacity of around 350,000 daily barrels. A consortium including the NOC, ConocoPhillips, Total, and Hess owns the field.

One of the strategic projects implemented by the Waha Oil Company is the Faregh field development, which is considered the biggest project executed by the oil sector in Libya since 2011. The second phase of this development aims to increase production significantly.

Libya has been planning to allow foreign oil companies to reinvest in its oil production following a self-imposed moratorium. This suggests an openness to international collaboration in the energy sector, although the primary oversight of the new pipeline project has been entrusted to a domestic entity. The NOC’s decision to choose Oilinvest for the pipeline project aligns with Libya’s history of significant oil and gas projects and the country’s potential for further development in this sector. The Waha oil fields and the Sirte basin are known for their oil production, and the new pipeline is expected to contribute to the growth and efficiency of Libya’s oil industry.

In summary, the NOC’s selection of Oilinvest for the $2 billion pipeline project in the Waha oil fields signifies a major investment in Libya’s oil infrastructure, with potential implications for the country’s economy and energy sector. The choice of a Libyan sovereign wealth fund subsidiary over other regional competitors may reflect national strategic interests and a focus on domestic oversight of critical energy infrastructure.

MOST COMMENTED

Book Release / Fiction / Literature / media / Podcast

Isabelle Richard’s Novel, “The Unwritten Chapter” + Podcast Review

Current Affairs / Geopolitics / Gulf / International Affairs / Iran / Islam / Israel / media / MENA Matters / Middle East / New Release / Our Books / Podcast

The Blackmail Doctrine: Trump, Israel, And The Arab Compliance + PODCAST REVIEW

Book Release / Current Affairs / Geopolitics / MENA Matters

La doctrine du chantage: Trump, Israël et la soumission des États arabes

Analyses & Commentaries / GEW Intelligence Unit / Research Paper

Iran’s Enduring Resilience: Why a Decisive Defeat is Elusive, Even with US Intervention

France / Littérature / media / Nos livres / Podcast

Le cercle restreint (Roman) : Présentation+ Podcast critique

Essais / Gulf / Iran / Israel / media / Podcast

La forteresse résiliente: Évaluer la puissance de l’Iran dans un contexte de confrontation moderne ( + critique en podcast)

Book Release / Collection: Geopolitics / Current Affairs / Iran / Podcast

The Resilient Fortress: Assessing Iran’s Power In A Modern Confrontation