GEW Intelligence Unit

With Dr Hichem Karoui (Research Director)

Introduction

In June 2025, a significant 12-day conflict involving Iran, Israel, and the United States led to targeted military strikes on Iranian nuclear facilities and energy infrastructure, culminating in a fragile ceasefire as of June 29, 2025. This conflict has exacerbated Iran’s pre-existing economic challenges, including high inflation, currency devaluation, and international sanctions. This report employs the PESTLE framework—covering Political, Economic, Social, Technological, Legal, and Environmental factors—to analyze the multifaceted impacts of the war on Iran’s economy. Given the recent nature of the conflict, some data is preliminary, and long-term effects remain uncertain.

PESTLE Analysis

1. Political Factors

- Instability and Potential Regime Change: The war has likely intensified political instability in Iran. Reports suggest early signs of regime change, with the government losing its monopoly on force and authority (The National). This could disrupt economic policy implementation and investor confidence.

- Strained International Relations: The conflict has further deteriorated Iran’s relations with the USA and Israel, reinforcing its international isolation. Tehran’s refusal to resume nuclear negotiations with the US (CNN) limits diplomatic avenues for economic relief.

- Governance Challenges: The government’s ability to manage the economy effectively is likely compromised, as resources are diverted to military recovery and internal security, potentially leading to further unrest.

2. Economic Factors

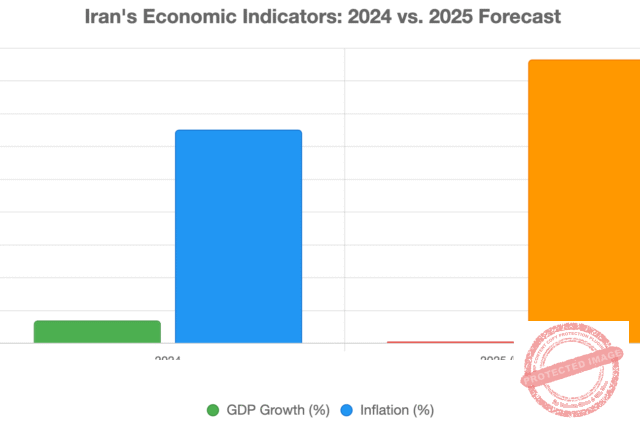

- GDP Growth Stagnation: The International Monetary Fund (IMF) forecasts Iran’s real GDP growth to plummet from 3.5% in 2024 to 0.3% in 2025, reflecting the war’s severe economic toll (The National). This near-zero growth indicates a significant slowdown in economic activity.

- High Inflation: Inflation is projected to rise from 32.6% in 2024 to 43.3% in 2025, eroding household purchasing power and pushing domestic industries toward collapse (IMF). This exacerbates economic hardship for citizens.

- Currency Devaluation: The Iranian rial has devalued sharply, reaching an exchange rate of 92,250 rials to $1 on June 23, 2025, compared to earlier lows (The National). This increases the cost of imports and fuels inflation.

- Oil Sector Disruptions: Iran’s oil industry, a critical economic driver, has likely suffered from damaged infrastructure, such as the South Pars gas field and refineries (New York Times). Oil exports, primarily to China, are expected to decline by 300,000 barrels per day in 2025 (Iran News Update), reducing vital revenue.

- Sectoral Impacts: The transport sector is severely affected, with lorry drivers’ strikes and an explosion at Bandar Abbas exacerbating supply chain bottlenecks (The National). This has led to shortages and surging prices.

- Capital Market Uncertainty: Iran’s stock market, currently closed, is expected to react negatively to the war, with high uncertainty deterring investment (The National).

3. Social Factors

- Population Displacement: Residents are reportedly leaving major cities like Tehran, Tabriz, and Isfahan, indicating significant social displacement and potential refugee crises (The National).

- Increased Poverty and Unemployment: High inflation and economic stagnation are driving up poverty and unemployment rates, with the IMF estimating unemployment at 9.5% in 2025, up from 7.8% in 2024 (Tehran Times). This is likely to lower living standards and increase social tensions.

- Potential for Unrest: Economic hardships and political instability may fuel social unrest, further complicating recovery efforts (NCRI).

4. Technological Factors

- Infrastructure Damage: The war has likely damaged critical technological infrastructure, particularly in the energy and nuclear sectors, with US and Israeli strikes targeting facilities like Fordow, Natanz, and Isfahan (CNN).

- Innovation Constraints: Resources diverted to military recovery may limit investment in technological innovation, hindering long-term economic growth.

5. Legal Factors

- International Sanctions: Iran continues to face stringent US sanctions, tightened under the Trump administration, targeting oil exports and financial networks (Iran News Update). These restrictions severely limit access to international markets.

- FATF Blacklist: Iran’s inclusion on the Financial Action Task Force (FATF) blacklist further restricts its ability to engage in global trade and finance (The National).

- Post-War Legal Challenges: The conflict may lead to additional international legal measures or sanctions, further complicating economic recovery.

6. Environmental Factors

- Energy Infrastructure Damage: Attacks on energy facilities, such as the South Pars gas field and oil refineries, pose environmental risks, including potential oil spills and pollution (New York Times).

- Humanitarian Concerns: Damaged infrastructure could disrupt essential services like water and power, potentially leading to humanitarian crises (The National).

Key Economic Indicators

The following table summarizes key economic indicators before and after the conflict, highlighting the war’s impact:

| Indicator | 2024 | 2025 (Forecast) |

|---|---|---|

| GDP Growth (%) | 3.5 | 0.3 |

| Inflation (%) | 32.6 | 43.3 |

| Exchange Rate (rials/$) | Not specified | 92,250 (June 23, 2025) |

| Unemployment (%) | 7.8 | 9.5 |

| Oil Exports (bpd) | 1.48M | 1.18M (projected) |

Note: Oil export data for 2025 is based on a projected decline of 300,000 barrels per day from early 2025 levels (Iran News Update).

Conclusion

The June 2025 conflict has significantly worsened Iran’s economic outlook, compounding challenges from long-standing sanctions, high inflation, and currency devaluation. The PESTLE analysis reveals a complex interplay of political instability, economic stagnation, social displacement, technological setbacks, legal constraints, and environmental risks. The projected near-zero GDP growth and soaring inflation underscore the severity of the economic downturn. Political instability and potential regime change further complicate recovery efforts, while disruptions to the oil sector threaten Iran’s primary revenue source. Social challenges, including displacement and poverty, could lead to unrest, and environmental damage poses additional risks. As Iran navigates the post-war environment, the government faces significant hurdles in stabilizing the economy and addressing the needs of its population. The fragile ceasefire offers a window for recovery, but the path forward remains uncertain.

Key Citations

- War’s effect on Iran’s economy will be devastating

- IMF: Islamic Republic of Iran economic data

- Al Jazeera: Israel-Iran war’s global economic impact

- Responsible Statecraft: US strikes on Iran unleash economic pain

- Noahpinion: Economic consequences of a war with Iran

- CNN: Live updates on Israel-Iran conflict June 21, 2025

- New York Times: Iran’s oil industry vulnerability in conflict

- Iran News Update: IMF warns of Iran’s economic stagnation

- Tehran Times: IMF forecasts economic improvement for Iran

- NCRI: Iran’s economic collapse and social unrest 2025

MOST COMMENTED

Analyses & Commentaries / Current Affairs / Economy / Economy and Development / GEW Intelligence Unit / Gulf / Research

Iran’s Economy Post-War

Book Release / Current Affairs / Essays / Gulf / International Relations / Our Books / Podcast

The Gulf and the War Against Iran

Analyses & Commentaries / Briefings and Reports / Current Affairs / Diplomacy / Geopolitics / International Affairs

Peace Through Strength or Path to Isolation? A Comprehensive Analysis of Contemporary Coercive Diplomacy and Historical Parallels

Analyses & Commentaries / Current Affairs / Geopolitics / GEW Assessment Report / Middle East / The Gulf

The Battle Over Truth: Analyzing Conflicting Narratives on US Strikes Against Iranian Nuclear Facilities

Analyses & Commentaries / Current Affairs / GEW Anti-Fascist Briefs / GEW Intelligence Unit / Gulf / Iran / Israel / Middle East / The Gulf

The Gulf Cooperation Council’s Strategic Dilemma: Real Positions on the Iran-Israel War

Book Release / Fiction / Literature / media / Podcast

Isabelle Richard’s Novel, “The Unwritten Chapter” + Podcast Review